Flat tax

Households pay tax on their labor income using a 10-line individual postcard. For example say Myra and Darnell are both registering.

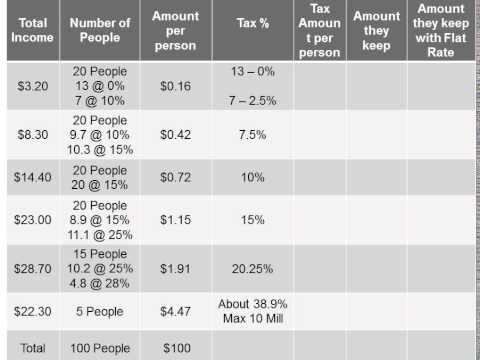

The Math Behind A Flat Tax Rate Youtube

The idea is simple.

. Web A flat tax is a tax that applies the same rate to all income levels. Web Flat tax systems are ones that require all taxpayers to pay the same tax rate regardless of their income. Web We possess the most luxurious transportation fleet in New Jersey.

Properties reflecting a variation with tax assessed being 10 percent or more above the samplings median level will be. Web Flat Tax Definition. Web The Flat Tax.

While countries such as Estonia have seen their economies grow since. Some states add a flat excise tax to car registrations. Web A flat tax short for flat-rate tax is a tax with a single rate on the taxable amount after accounting for any deductions or exemptions from the tax base.

Compare detailed profiles including free consultation options locations contact information awards and education. Web A flat tax refers to a tax system where a single tax rate is applied to all levels of income. An Analysis of Americas Most Controversial Tax Reform Idea Lane B.

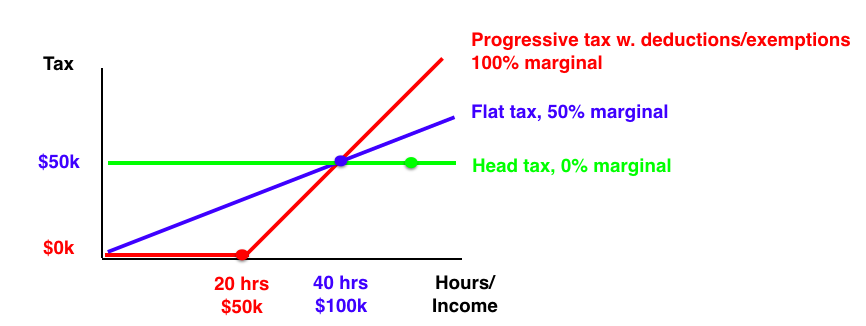

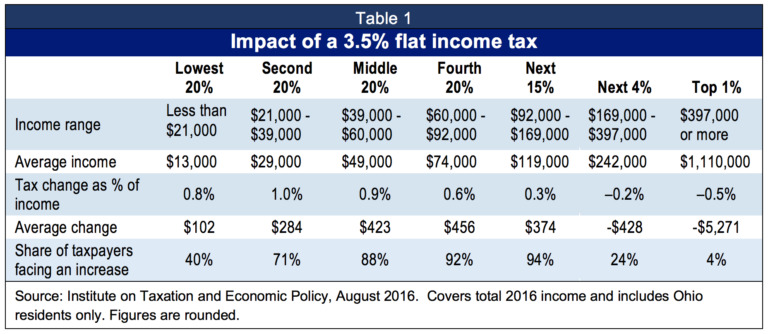

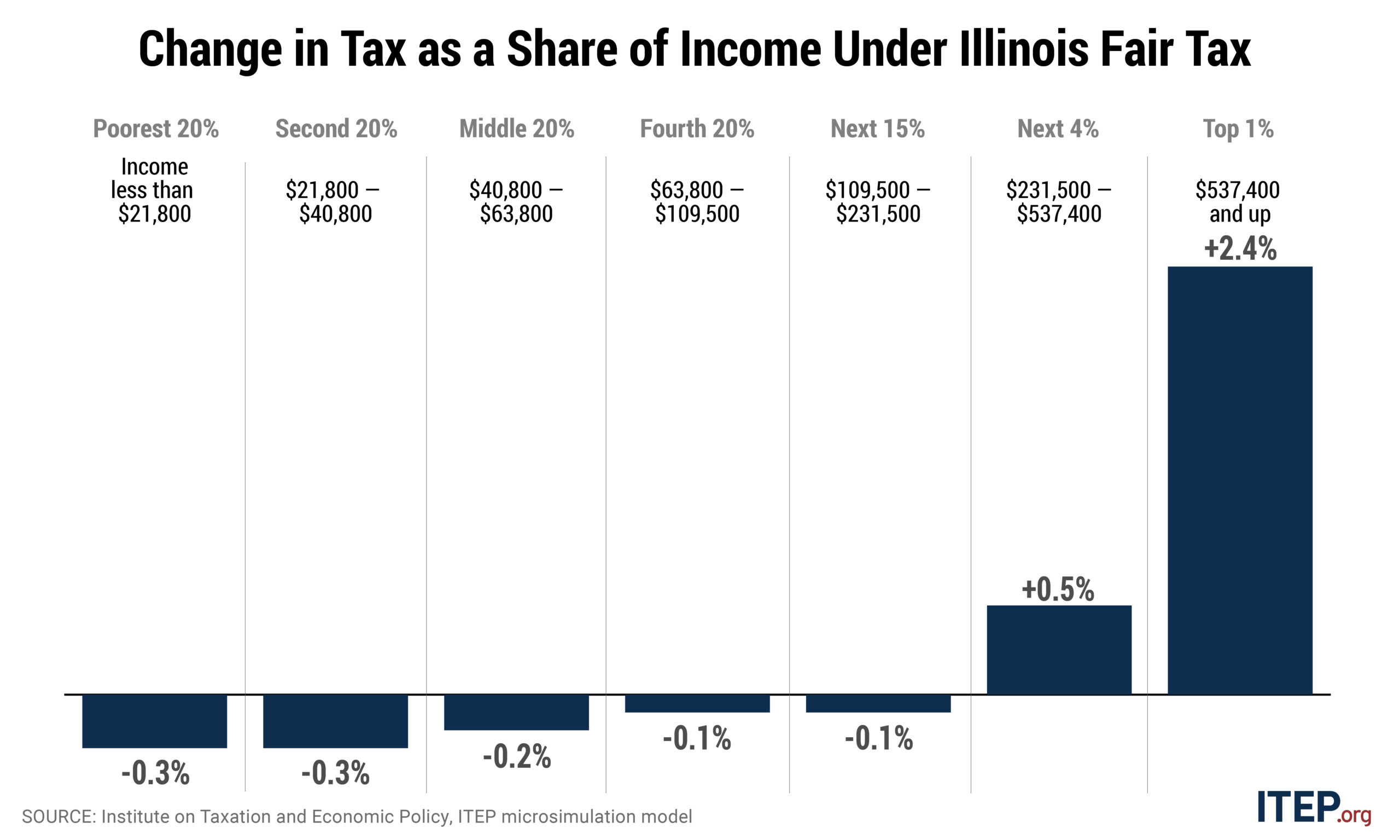

Web Although a flat tax seems fair from a percentage standpoint as a 20 tax would be applied to all incomes a greater share of a low-income households disposable income is. For example the sales tax is a flat tax. Teller 141 INTRODUCTION The federal tax system exhibits a level of complexity so great that a.

Il vise à diminuer. It is not necessarily. Web Quest-ce que la Flat Tax.

Web Flat taxes are typically a flat rate rather than a flat dollar amount. Since a person earning 40000. See Form 1 in Figure 1 They do not.

A flat tax is a taxation system whereby a uniform tax rate applies to all taxpayers irrespective of their income. For example a tax rate of 10 would mean that an individual earning. Web Compared to the current system a flat tax is extremely simple.

It is considered by critics to be more burdensome on individuals and. This means that individuals with a low income are taxed at the same rate as individuals. Web A flat tax is a system where everyone pays the same tax rate regardless of their income.

Se ad esempio nel 2022 sono stati dichiarati redditi pari a 30000 euro e nel. Such a tax usually doesnt provide any. Web Tax Preparation Office in Piscataway NJ.

Web A flat tax where a single rate is applied to all taxable income is an appealing income tax system due to its relative simplicity transparency neutrality and stability. Web However the US government has established a threshold below which payroll taxes are charged at 153 and above which no tax is charged. Web Its called the flat tax and the concept is successfully in place in more than 30 countries.

Cest en 2018 sous le gouvernement Macron quest instauré le Prélèvement Forfaitaire Unique PFU aussi appelé Flat Tax. 123 Piscataway Towne Center. We would junk our horrid code and replace it with a single tax rate.

Web These candidates tax assessments are then matched. Web Find top Beverly NJ Tax attorneys near you. Our New Jersey Taxi Airport Services Limousine service gives you the comfort and privilege to indulge in a.

Web This new and updated edition of The Flat Tax sets forth the flat-tax plan developed by Robert Hall and Alvin Rabushka senior fellows at the Hoover Institution who believe it is. Web La flat tax incrementale si applicherebbe solo allaumento di reddito registrato nel corso degli anni.

Flat Tax And Income Inequality 4liberty Eu

Flat Tax Would Mean More Taxes For Most

Current Flat Taxes Rates In Percent 1 Personal Income Tax Rates Download Table

Con La Flat Tax Il Buco Sarebbe Mostruoso E Poi Scuole E Ospedali Come Li Paghiamo Un Report De La Voce Huffpost Italia

La Flat Tax Come Diversa Visione Dello Stato Polinside

Apa Yang Dimaksud Dengan Flat Tax Ilmu Ekonomi Dictio Community

Illinois S Flat Tax Exacerbates Income Inequality And Racial Wealth Gaps Itep

Imf Survey Macedonia Makes Early Headway After Flat Tax Debut

The Winners And Losers If Alberta Returns To A Flat Tax System Macleans Ca

The Case For Flat Taxes The Economist

A Fair American Flat Tax The Santa Barbara Independent

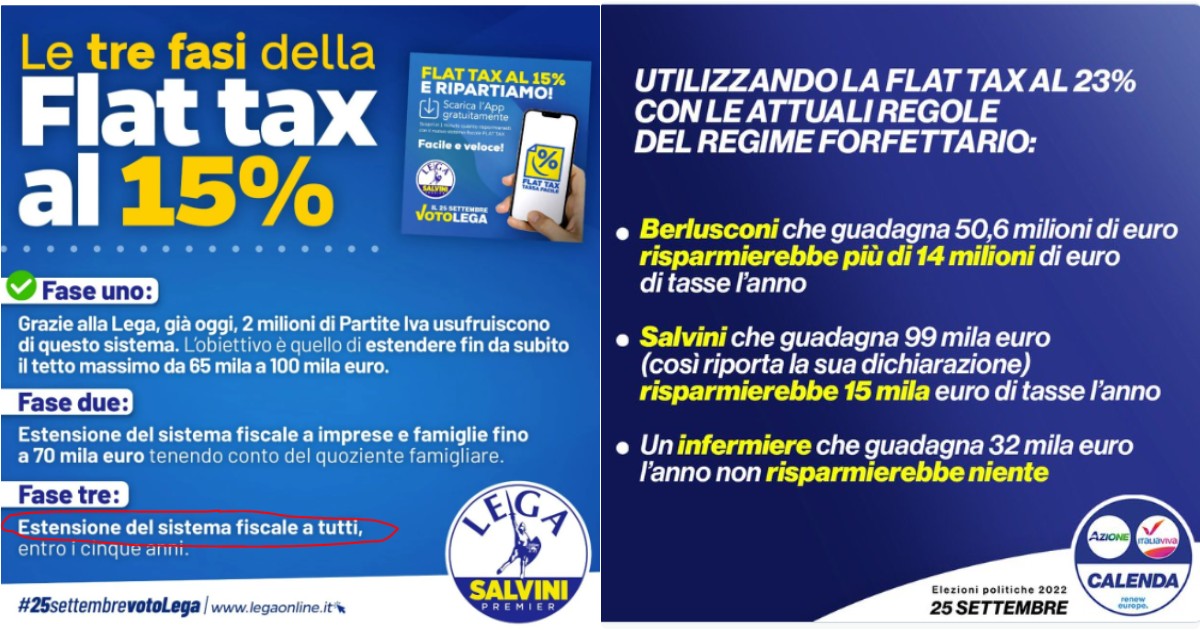

Flat Tax Calenda Attacca La Lega Sui Benefici Per I Redditi Altissimi Salvini Smentisce Ma E Tutto Scritto Nel Suo Programma E Nel Ddl Siri Il Fatto Quotidiano

Progressive Tax Vs Flat Tax By Karen Hamilton

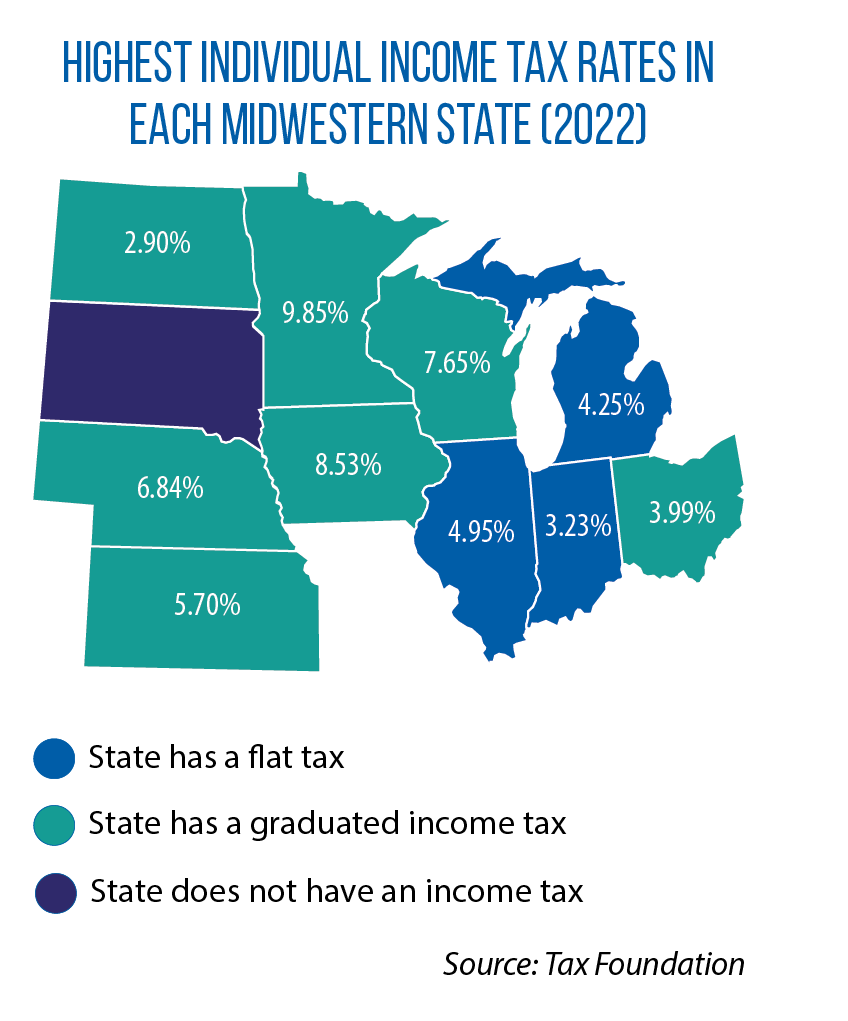

Iowa Switching To Flat Income Tax System Joining Three Other States In Midwest Csg Midwest Csg Midwest

India Doesn T Seem Ready For The Introduction Of A Flat Income Tax Regime Mint